Investors face a dual dilemma of low yields in bonds and high risks in stocks that make investing for the future more difficult.

The Dual Dilemma Puts Investors in Between a Rock and a Hard Place

The dual dilemma is an investment challenge changing the way investors and advisors build investment portfolios and financial plans.

The dual dilemma is the combination of risks in the stock and bond markets leaving investors unprepared for meeting their long-term financial goals. Stock markets are volatile and unpredictable while current low interest rates mean low income for bond investors.

With both bonds and stocks posing significant risk to investors’ financial goals, the dual dilemma presents investors with two undesirable choices: accept more risk for return or accept low income and returns.

Stock Market Risks: Unpredictable Losses

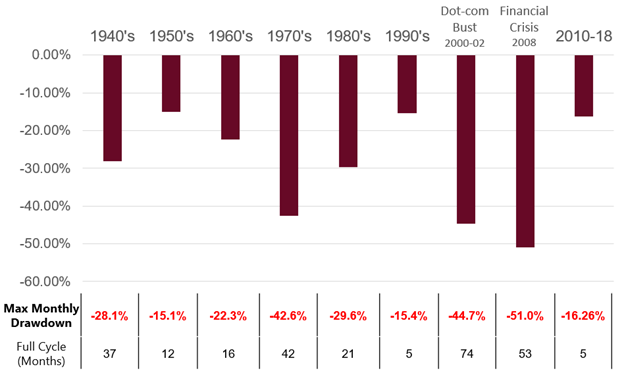

Stocks have always been unpredictable. Since 1929, bear markets on average occur every 3.8 years; erase 35% of market value; and take 3.3 years to recover*.

67% of the time the U.S. large cap equity market spends either losing or recovering (Source: Zephyr and Swan Global Investments. Based on total return. Data from 1/1/1974 through 12/31/2018. Past performance is no guarantee of future results)

The industry has long touted the benefits of passive investing strategies. But market volatility makes it hard for investors to buy and hold. This is because most investments are focused on beating the market rather than protecting investors’ hard-earned money.

Investors are terrified of losing money. For good reason, too: the more they lose, the more they need to get back to even.

The math behind successful investing depends on avoiding large losses.

It’s not a coincidence that loss aversion is the most powerful investing bias that derails investors from their goals.

Current anxiety and uncertainty surrounding the stock market now is driving high demand for bonds, which hold their own risks.

Bond Risks: No Money in Safe Money

The current state of bonds is undermining the dual role bonds have always provided investors’ portfolios: protection and income.

Now, investors must choose between income or protection; they can’t have both. Low yields are punishing savers and forcing investors to take on more risks in search of income and return. When rates rise eventually, the current bond holding may lose value.

Rising rates hurt bond values while low or falling rates hurt. Either way, bonds seem ill-positioned to repeat returns of the past 3 decades.

Solving Dual Dilemma with Hedged Equity

Investors need to stay invested in stocks to grow wealth and generate income needs, but most investors cannot afford another large drawdown and long recovery. Meanwhile, bonds may not be able to serve their portfolio protection role or their income role.

We believe hedged equity can help solve the dual dilemma for investors.

Hedging is simply the act of seeking to mitigate potential losses.

Hedged equity is an investing approach that invests in equity (stocks) for growth and seeks

to hedge (mitigate) against big losses.

Hedged equity may preserve irreplaceable capital while providing the potential for growth

from stocks.