Investing redefined simply means offering investors a better way to invest so they may preserve the wealth and achieve the growth they need to reach their long-term goals.

Investing redefined simply means offering investors a better way to invest so they may preserve the wealth they work so hard to earn and achieve the growth they need to reach their long-term goals.

The investing landscape has changed, and the traditional investing strategies will be unable to guide investors to their financial goals like they have done in the past.

The traditional portfolio, comprised primarily of two tools (stocks and bonds), faces historic challenges that may leave investors unprepared for meeting their long-term financial goals.

Stocks have always been unpredictable, but volatility and bear markets make difficult to buy and hold long term. Due to low interest rates, bonds may not provide the protection or income investors need.

This is why we're redefining investing.

Investing redefined is more than just a different strategy or product, however. It's also about changing the way investors think about investing.

Rethinking Risk & Returns

To redefine investing, we first have to rethink risk and returns and what guides investors' decisions.

Redefining Risk

The finance industry defines risk as standard deviation, or volatility. Investors, however, identify risk in different terms: large losses.

In fact, 77% of investors prefer portfolio protection, even at the risk of underperformance (Cerulli Associates, The Cerulli Edge, January 2018). This means, investors would rather preserve their money than take the risk of high returns.

Despite this, performance metrics and reports focus more on "beating the market" and outperformance than whether an investment does a good job preserving wealth. More often than not, investors claim to want to outperformance, but as behavioral finance has shown us, the fear of losing money is stronger. This is why we're fans of the pain index metric for risk because it measures the depth, duration, and frequency of losses.

This loss aversion makes sense emotionally and mathematically. The biggest risk, or threat, to investors' financial goals is losing big. This is why avoiding large losses is crucial for long-term investment success.

So we seek to define risk—limit the risk of losing big—so investors may be better positioned to achieve long-term goals.

Redefining Returns

Investing redefined is about guiding investors to their long-term financial goals. But the 24-hour news cycle and quarterly performance reports feeds the hunger for short-term outperformance which can lead to unmet expectations and market timing risks.

Instead, we rethink returns in a way that align better with goals-based investing.

We believe rolling returns are better than trailing returns (1-, 3-, 5-yr performance numbers) for measuring and judging returns. While trailing returns are inconsistent and produce unrealistic expectations, rolling returns offer a more comprehensive view that shows an investments long-term consistency, reflects the investor experience, and manages investor expectations better. We dive deeper into this comparison in our post, "Trailing vs Rolling Returns: Redefining the Conversation about Returns."

Reconstructing the Modern Portfolio

We believe Modern Portfolio Theory (the traditional investing strategy of the stock and bond portfolio) based on diversification through asset allocation has failed to grow or protect investors' wealth in the new investing landscape with low bond yields and uncertain stock markets.

The Problem with Asset Allocation

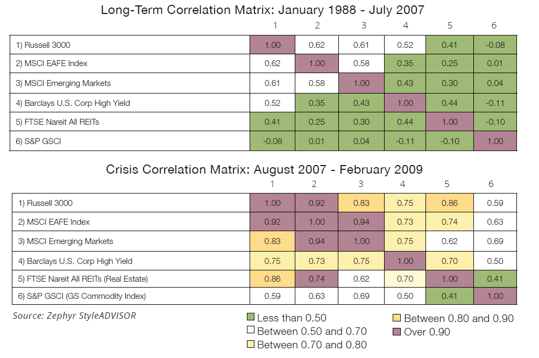

Modern Portfolio Theory (MPT) and asset allocation claim that the risk of loss can be reduced with diversification. However, the success of this approach depends on those various assets being uncorrelated to one another, which isn't always the case. The 2008 Financial Crisis showed this this when almost asset classes had positive correlations—going down together as the market was going down.

This is because the risk reduction is theoretical and based on a historical relationships that may or may not continue on into the future. Risk is not defined but merely expressed in historical standards.

True diversification is when two or more investments react differently to the market. Yet most portfolios contain false diversification, where they slice and dice the market into smaller pieces within the same segment.

Hidden correlations and false diversification are two culprits to why the modern portfolio fails to provide the risk management investors need and want. But another risk that has come to the fore is the bond market.

Bleak Future of Bonds

Bonds have helped investors manage risk and collect income for years. But the bull market in bonds is over, leaving investors with fewer places to turn for the traditional benefits bonds used to provide.

Bonds have the been the Achilles' Heel of the portfolio and will be going forward for the following reasons:

- Low Treasury yields have been suppressed for a long time, punishing savers and bond holders.

- Credit quality in corporate bonds has been deteriorating.

- High yield and collateralized loan obligations (CLOs) are showing worrisome similarities to the mortgage backed securities at the root of the 2008 Financial Crisis.

These risks combined with the fiscal outlook in the wake of COVID-19 is pushing advisors and investors to look beyond traditional allocation for risk management, returns, and income. What was once a dependable risk management and income tool has now increased the risk in investors' portfolios.

We cover the impact of bonds on portfolios in our white paper, "The Bleak Future of Bonds," and the follow up post, "The Dire Outlook for Bonds in the Wake of COVID-19."

Instead of depending on historical correlations, market timing, or bonds to manage risk, we utilize put options to offset potential losses in the market. Put options are inversely correlated to the stock by it's very nature and provides a truly uncorrelated investment.

Investing Redefined: An Investment Strategy for a Changing World

The investing landscape has changed in significant and permanent ways with new players and new conditions that were not around when MPT was first developed in 1952. Therefore, investors need to redefine how they consider risk and how they invest going forward.

That's why we manage the Defined Risk Strategy, a hedged equity strategy that focuses on what matters most to investors--having the money they need when they need it.